Summary. Small business bookkeeping is crucial, especially regarding expenditure on infrastructure. Accurate bookkeeping ensures correct tax savings, and distinguishing between repairs and improvements can affect tax liabilities. Thomas Nock Martin in Brierley Hill provides expert guidance in this domain.

Keeping on top of your bookkeeping is paramount when running a small business. However, it is especially important for expenditure on buildings and equipment. Did you know, accurate small business bookkeeping can also save you tax? Based in Brierley Hill, Thomas Nock Martin Chartered Accountants can help you stay on top of your bookkeeping.

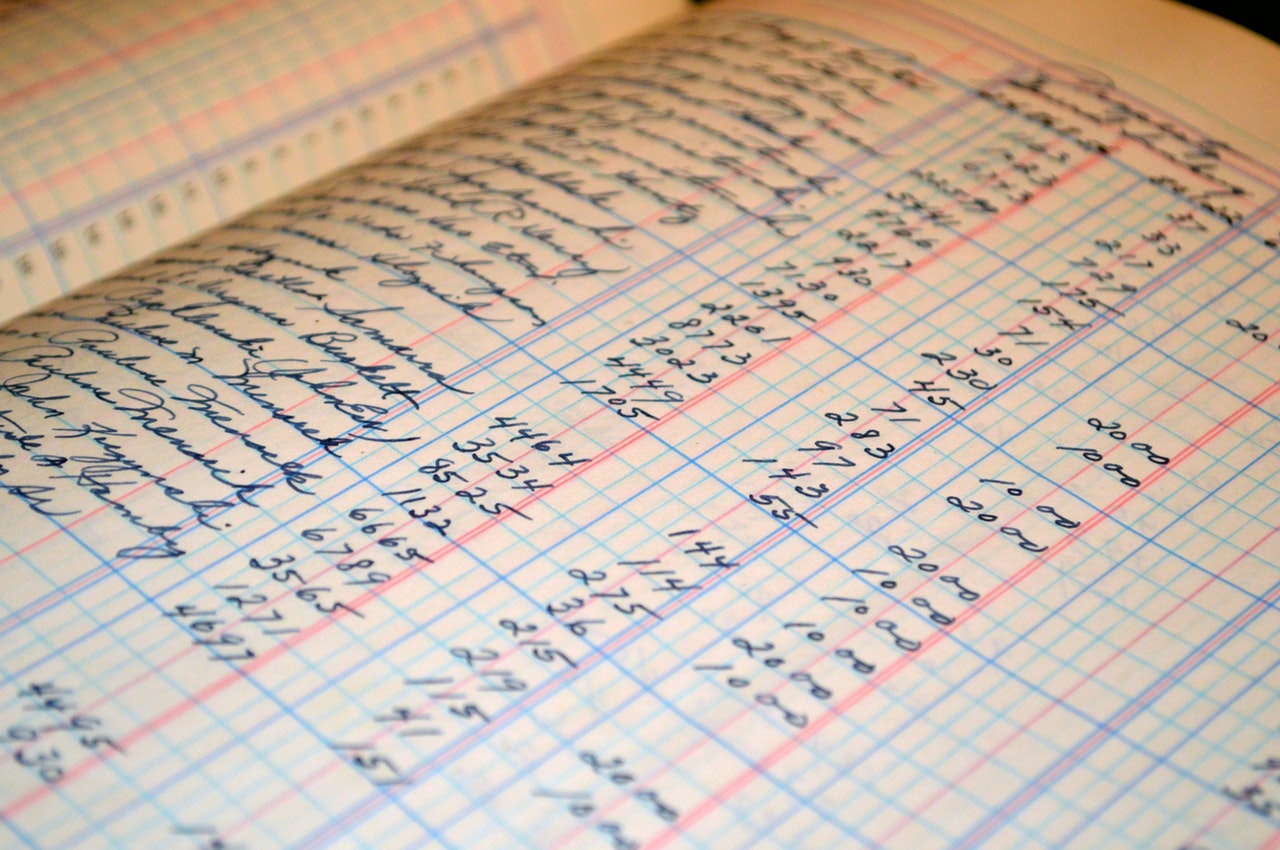

Small business bookkeeping

Small business bookkeeping is important – whether it’s for tax purposes, expenses, cash flow, or profitability and growth. One major benefit is that you can claim the tax against expenditure on buildings and equipment that you’re entitled to, correctly. However, it is often tricky to choose the right heading for expenditure on buildings equipment.

Repairs v improvements

HMRC has been outlining that expenditure on repairs to an asset is an allowable item for tax purposes. It is fully deductible from any profit made. But, if you alter, improve, or replace the asset, the expenditure is capital expenditure and not allowable. You need to note this as an increase in the value of the asset with the deduction from profit spread over more than one year as depreciation charges.

In general terms if you replace the entire asset, it will be viewed as capital expenditure. Whereas if less than the entire asset has been replaced this will be viewed as revenue expenditure. Therefore, this is tax deductible.

For example: A business has a driveway leading to the collection point for its goods. The driveway is in very bad condition as the last time it had any attention was over 20 years ago. As a result, the delivery drivers are refusing to collect their goods as the driveway is causing damage to their vehicles.

The business has the driveway repaired at a cost of some £50,000. The tarmac is removed and the sub-surface repaired. It is then re-surfaced with a new kerb to bring it up to today’s standards.

So what is the difference?

As the driveway has been resurfaced and not replaced in its entirety, the expenditure is allowable for tax purposes as a repair. However, if the business owner chose to widen the driveway or increase the load bearing weight, it would have been seen as an improvement, therefore not allowable.

The HMRC equivalent to this is capital allowances (CAs), which has its own rules and timeframes for tax deductions. If you record your expenditures incorrectly, you could end up with an incorrect tax bill. Don’t be tempted to wrongly record repair work as improvement expenditure. This can leave you with extra tax charges when you vacate the premises.

Claiming back CAs for business expenditure

When you sell your business premises, you can potentially claim back any CAs you have been claiming for expenditure on improvements. The buyer can claim CAs on the cost of whatever they paid for fixtures. This means they will be keen to settle on a high value. This is beneficial to you because if the value you agree is greater than the original cost minus the CAs you have claimed for, you can claim tax on the difference.

Example: A business spends £50,000 on refurbishing its premises, and allocates £40,000 to fixtures, of which CAs are claimed. They then sell the premises and agree an amount of £15,000 for the fixtures. This means the business claimed £40,000 of CAs for the fixtures and £15,000 of these would be clawed back and taxed as extra profit.

Alternative tax options

If you have been allocated £40,000 for repairs instead of improvements, claiming back on CAs is not an option. Instead, any money you have received would included as proceeds in the capital gains tax (CGT) sum. It is possible that this could give you a lower tax bill overall.

How to decide which option is better for you

If your business is unincorporated a tax saving is more likely, as money back from CAs is taxed at income tax rates of up to 45%, whereas CGT is payable at just 10% or 20%.

It’s important that you title any invoices / bills you receive for work on your premises. You also need to make sure that they sit comfortably under either repairs or improvements. This will save you a lot of legwork at a later date. If you are not sure, err on the side of caution and categorise it under repairs.

Trusted West Midlands Chartered Accountants

Small business accounting can be challenging. It is an area where the incorrect tax treatment can cause you potential difficulties with HMRC. You need to stay on top of bookkeeping and be organised in order to get it right.

If you need advice on small business bookkeeping then Thomas Nock Martin Chartered Accountants are on hand. Just head to our website today. Alternatively, call 01384 261300 to find out more about our small business accounting services.

If you have found this blog helpful, you may wish to read our previous blog on Landlord Expenses.